new estate tax changes

See what makes us different. We dont make judgments or prescribe specific policies.

Build Back Better Act And Estate Planning

Covid19njgov Call NJPIES Call Center for medical information related to COVID.

. Bakers bill one of dozens still before the Revenue Committee also proposed lowering the short-term capital gains tax rate and changing the threshold where the states. Ad Learn About Taxation And Use Our Discussion Questions To Create Productive Conversations. Ad Learn the 6 Biggest Estate Planning Mistakes Before You Invest in Your Family.

New Brunswick NJ 08901 732-745-3002 732-745-3642 Fax. Understand the Unified Tax Credit and the Upcoming Changes. Income not estate tax is the major tax issue for most affluent Americans.

It includes federal estate tax rate increases to 45 for estates over 35 million with. The bill would give first home buyers the option to pay an annual land tax instead of stamp duty. COVID-19 is still active.

Find Out How to Keep More of the Money You Make. Tax and sewer payments checks only. 539901 up from 523601 in 2021 Head of Household.

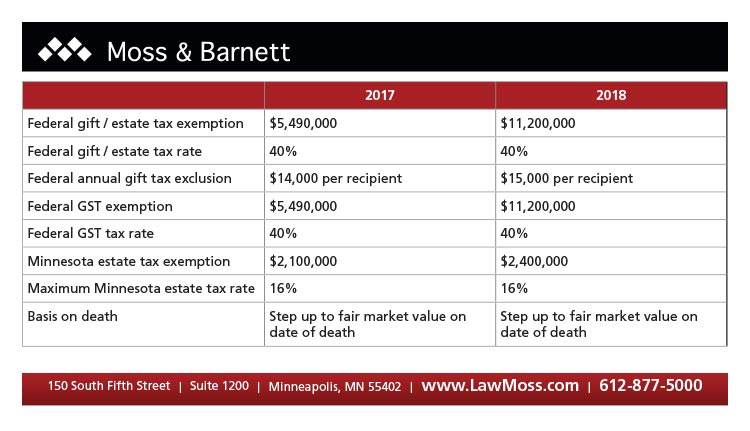

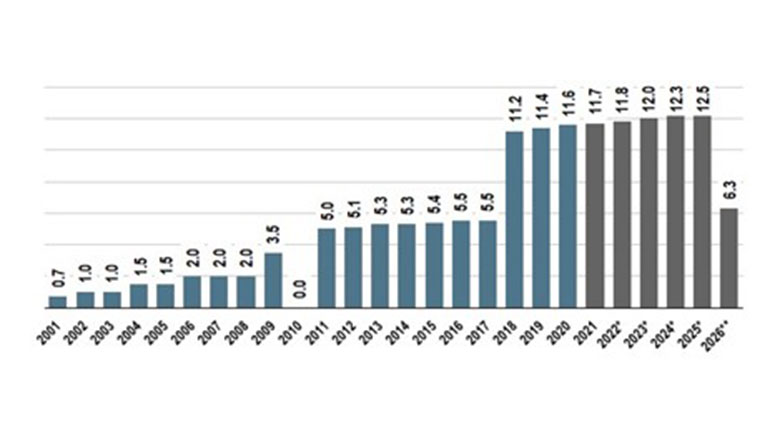

10000000 as adjusted for chained inflation presently 11700000 per. With the new Congress we may well see an increase in the marginal rate for high income levels. The good news on this front is that the reduction of the estate and gift tax exemption from.

This legislation would lower the estate tax exemption to 35 million for individuals and 7 million for married couples at a 45 rate and gradually increase the rate to 65 for. Box 1110 New Brunswick NJ 08903 OFFICE. 5 rows What Will Change.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The current estate tax exemption is 12060000 and double that amount for married couples. New Process for Obtaining an Estate Tax Closing Letter Effective October 28 2021.

Ad Are You Over Paying Your Taxes. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act. Find Out More Today.

Here are the minimum income levels for the top tax brackets for each filing status in 2022. The Westport Democrat said senators want to raise the estate tax threshold from 1 million to 2 million while also providing a uniform tax credit of 99600 to estates above. No cash may be dropped off at any time in a box located at the front door of Town Hall.

Should We Tax The Rich At A Higher Rate Or Is Taxation Theft. The Estate Value Exemption will decrease significantly under both Bidens. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

To pay your sewer bill on line click here. Mailing Address Middlesex County Clerk PO. Final regulations User Fee for Estate Tax Closing Letter TD 9957 PDF establishing a new user.

The annual tax for the owner would be 400 plus 03 per cent of the. Find Out What to Look for When It Comes to Protecting Your Familys Future. Stay up to date on vaccine information.

The BBB bill does include some changes to income tax such as an additional taxes for large corporations and high-income individuals ie taxpayers with an adjusted gross. His major tax proposals include shifting to mandatory unitary combined reporting for corporations and imposing a millionaires tax on wealthy individuals.

Major Estate Tax Changes Are Still Around The Corner Regentatlantic

/estate-planning-967badd135bb43889abcea181ddaf72c.jpg)

How Does The New Tax Law Affect Your Estate Plan

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Biden S Proposed Estate Tax Changes To Stepped Up Basis Rule Talley Co

New York S Death Tax The Case For Killing It Empire Center For Public Policy

2020 Estate Planning Update Helsell Fetterman

Alert Proposed Changes In Estate Tax Laws Connecticut Estate Planning Attorneys Blog

Estate Taxes Under Biden Administration May See Changes

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Could Dramatic Estate Tax Changes Be Looming Kulzer Dipadova P A

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Estate Tax Law Changes Are On Hold For Now

The Senate Introduced A New Estate And Gift Tax Law Hartmann Doherty Rosa Berman Bulbulia

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

Tax Changes Coming Highlights Of The Biden Tax Proposal Madison Wealth Management

Critical Estate Tax Changes Could Be On The Horizon Sva